How To Set Up Apple Pay On Iphone Se

Apple Pay Overview

Contents

- Apple tree Pay Overview

- Setting Up Apple tree Pay

- How It Works

- In More than Particular

- Apple tree Pay on the Spider web

- Apple tree Cash

- The Apple tree Card

- Tap to Pay on iPhone

- International Expansion

- Competition

- Apple Pay Timeline

Apple Pay is Apple's mobile payments service. As with the Apple Sentry, Apple has adopted the Apple tree symbol "" followed by "Pay" for the service's name, though the company also refers to it equally "Apple Pay."

Bachelor since October 20, 2022, Apple Pay is designed to allow iPhone half-dozen, 6s, vi, 7, 8, 6 Plus, 6s Plus, 7 Plus, 8 Plus, SE, 10, XS, XS Max, XR, iPhone xi, iPhone 12, and iPhone 13 users in the United States, the United Kingdom, Australia, Canada, Singapore, Switzerland, Hong Kong, French republic, Russia, China, Macau, Japan, New Zealand, Kingdom of spain, Taiwan, Ireland, Italy, Kingdom of denmark, Finland, Sweden, UAE, Brazil, Ukraine, Norway, Poland, Kingdom of belgium, Kazakhstan, Germany, Saudi arabia, South Africa, Austria, the Czech republic, Iceland, Hungary, Luxembourg, Holland, Republic of bulgaria, Croatia, Georgia, Cyprus, Estonia, Greece, Latvia, Liechtenstein, Lithuania, Malta, Portugal, Romania, Slovakia, Slovenia, Belarus, Serbia, Mexico, Israel, Qatar, Republic of chile, Bahrain, Palestine, Azerbaijan, Republic of costa rica, Colombia, Argentina, Peru, and Moldova to make payments for goods and services with their iPhones in retail stores using an NFC fleck built into their iPhones.

With the Apple Watch, Apple Pay also extends to the iPhone 5, iPhone 5c, and iPhone 5s. To use Apple Pay with ane of these devices, a paired Apple Lookout is required to brand the payment. This is fabricated possible through the NFC fleck included in the Apple Spotter. The Apple tree Watch can also make payments when paired with newer iPhones, then you don't need to pull your phone out to utilise the payments service.

Apple Pay also lets users make one-tap purchases inside apps that accept adopted the Apple Pay API, and it is available on the web on devices running iOS 10 or macOS Sierra or later. Devices capable of using Apple Pay inside iOS apps or on the spider web include the iPhone 6 and afterward, iPad Air 2 and after, iPad mini iii and afterwards, iPad Pro models, and Macs with Touch ID. All of these devices feature Bear upon ID or Face ID and incorporate an NFC controller where the "Secure Element" of Apple tree Pay is located, keeping customer data individual.

In 2022, Apple enabled person-to-person Apple Pay payments through the Messages app on the iPhone and Apple Watch. Using Apple Cash, you tin can send money to friends or family unit in the Us. Apple in August as well introduced its own credit menu, the Apple Card, which has unique perks and benefits and offers deep integration with Apple tree Pay and the Wallet app.

Apple tree Pay has seen a major change with the introduction of the iPhone 10 and later as these iPhones feature Face ID facial recognition instead of Touch ID fingerprint authentication. Facial scans rather than fingerprint scans are used to ostend payments on the new device.

To keep transactions secure, Apple tree uses a method known equally "tokenization," preventing actual credit bill of fare numbers from being sent over the air. Apple also secures payments using Touch ID or Face ID on compatible iPhones and continual skin contact on the Apple Watch.

Apple is aiming to supplant the wallet with Apple Pay, and the 1-footstep payment procedure prevents people from needing to dig through a purse or wallet to find credit or debit cards. Because it is built on existing NFC technology, Apple Pay works anywhere NFC-based contactless payments are accepted.

Every bit of 2022, Apple Pay has overtaken Starbucks to become the near popular mobile payment platform in the United States, and information technology is on track to account for 10 percent of global menu transactions by 2025.

Annotation: Encounter an fault in this roundup or want to offer feedback? Ship u.s. an email hither.

Setting Up Apple Pay

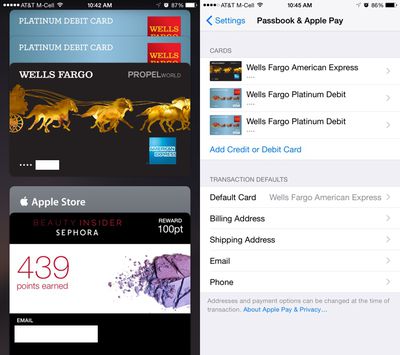

After installing iOS 8.i or later, Apple Pay tin can be set upwards in the Wallet app. Borer the "+" icon in Wallet lets users to add a credit or debit card to Apple Pay, either selecting a bill of fare already on file with iTunes or scanning one in with the photographic camera. Apple tree Pay tin can as well exist set by using the prompts when setting upwardly a new iPhone, iPad, or Mac.

Credit and debit cards are verified in but a few seconds, but some cards require a telephone telephone call, app download, or an email to verify a card before it can be added to Apple Pay. Once a card is verified, it is immediately bachelor for purchases both in stores and within apps. Up to eight cards tin be registered with Apple tree Pay at i fourth dimension.

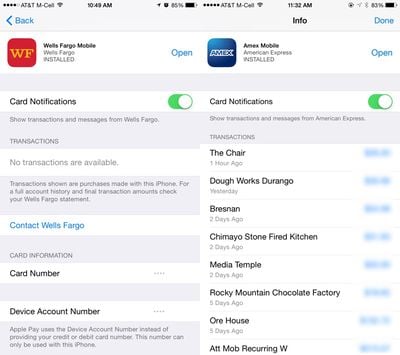

Apple Pay can exist managed in the Settings app, located in the "Wallet and Apple Pay" section. Each card added to Wallet is listed in that department, along with information similar billing address, email, and phone number. Borer on a bill of fare offers specific data like last digits of the bill of fare number, last digits of the Device Account Number that replaces the card number in transactions, and it also provides contact information for the banking company that issued the bill of fare.

Some cards are also able to brandish transaction information, offering a list of recent transactions that accept been made, with Apple Pay or with a traditional buy via physical carte.

Apple Pay How Tos

-

How to Change Your Default Carte for Apple Pay Purchases on Your iPhone

-

How to Change Your Default Bill of fare for Apple Pay Purchases on Your Apple tree Sentry

-

How to Change Your Default Menu for Apple Pay Purchases on Your Mac

How It Works

In a retail store, when approaching a point-of-sale system compatible with Apple Pay, the screen of the iPhone lights upward and opens Wallet automatically, where a user can tap on a credit carte du jour to exist used or pay with the default Apple Pay carte du jour.

A payment is made by holding a uniform iPhone or Apple tree Watch well-nigh a checkout system that includes NFC, most of which look like standard card checkout terminals within stores. A finger registered with Touch ID must be kept on the home push button for a brusk amount of time (or the Apple Watch must be kept on the wrist), subsequently which a payment is authenticated and the transaction is completed.

A completed payment is denoted by a slight vibration, a cheque marking on the screen, and a beep. On devices with Confront ID, a facial scan is used in lieu of a fingerprint scan, and a double tap is required on the side button of the device to confirm a payment.

In some stores and in some countries, users may even so be asked for a PIN lawmaking due to older indicate-of-sale machines, transaction limitations, and laws in certain countries, simply for the nigh part, checking out with Apple Pay is an piece of cake one-step process that does not require a signature or Pin.

With Apple Pay, a cashier does not see a credit card number, a name, an accost, or any other personally identifying information, making information technology more secure than traditional payment methods. There is no need to take out a credit card or confirm the actuality of a credit card with a driver'due south license or ID card, considering all of that information is stored on the iPhone and protected by several built-in security systems, including Touch ID.

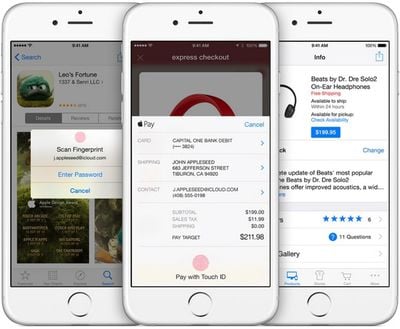

Making a payment online via Apple Pay is just every bit simple as an in store payment because it uses the same credit carte du jour and authenticates with Affect ID in participating apps that take adopted the Apple Pay API. Using Apple Pay in an app or on a website bypasses all of the steps that are usually required when making an online purchase, including entering shipping and payment information.

Afterward an item is added to an online cart and a user initiates the checkout process, Apple Pay can be selected as the payment method. The shipping/billing address associated with the credit or debit card on file is automatically entered, as is a user's name, and the purchase is confirmed via Touch ID. During this process, information like shipping address tin can be altered, which is useful when ordering a souvenir. Online payments using Apple Pay for the web follow the same procedure.

Online and retail store payments are both limited to participating merchants. Apple Pay is simply available within apps and on websites that accept adopted the Apple Pay API and to brand a payment in a retail location, the store needs to support Apple Pay directly or allow NFC payments.

In More than Item

Uniform Devices

Apple tree Pay in stores is available for the iPhone half dozen, 6s, 6 Plus, 6s Plus, SE, 7, 7 Plus, eight, 8 Plus, Ten, XS, XS Max, XR, 11, 11 Pro, 11 Pro Max, iPhone 12 mini, iPhone 12, iPhone 12 Pro, and iPhone 12 Pro Max, iPhone 13 mini, iPhone xiii, iPhone 13 Pro, iPhone xiii Pro Max, all of which contain near-field communication (NFC) chips that have not been incorporated into previous-generation iPhones.

Apple Pay also works with Apple Spotter, the company'south wrist-worn wearable device. The Apple Sentry allows owners of older iPhones, including the iPhone 5, 5c, and 5s, to use Apple tree Pay in retail stores. Though the Sentinel needs to be paired with a phone, Apple Pay can be used when the phone is not present.

Security

Apple puts a heavy accent on security when advertizing Apple tree Pay, to assure iPhone owners that their payment data is safety, and, in fact, safer on an iPhone than inside of a wallet. Co-ordinate to onetime credit carte executive Tom Noyes, the way Apple Pay has been designed to work makes it "the nigh secure payments scheme on the planet."

When a credit or debit card is scanned into Wallet for use with Apple Pay, it is assigned a unique Device Account Number, or "token," which is stored in the telephone rather than an actual bill of fare number.

The iPhone itself has a special dedicated chip called a Secure Element that contains all of a user's payment information, and credit carte du jour numbers and information are never uploaded to iCloud or Apple's servers. When a transaction is fabricated, the Device Account Number is sent via NFC, along with a dynamic security code unique to each transaction, both of which are used to verify a successful payment. The dynamic security lawmaking is a ane-time utilize cryptogram that replaces the credit card's CCV and is used to ensure that a transaction is being conducted from the device containing the Device Account Number.

Dynamic security codes and Device Account Numbers (aka, tokens and cryptograms) are not unique to Apple and are built into the NFC specification that the company is adopting. In fact, much of the Apple tree Pay system is congenital on existing technology.

Along with Device Account Numbers and dynamic security codes, Apple likewise authenticates each transaction through Affect ID or Face ID. Whenever a transaction is conducted with an iPhone, a user must place a finger on Touch ID or complete a facial scan for the payment to go through.

With the Apple Lookout man, hallmark is done through pare contact. When the scout is placed on the wrist, a user is prompted to enter their passcode. After a passcode is entered, as long as the device continues to have contact with the skin (which is monitored through the center charge per unit sensor), it's be able to be used to make payments. If the sentry is removed and skin contact is lost, information technology can no longer be used to make payments.

Both Touch ID, Face ID, and the skin contact authentication method in the Apple Lookout man forbid someone who has stolen an iPhone or Apple Watch from making an unauthorized payment.

Because Apple utilizes Device Business relationship Numbers, a user's credit card number is never shared with merchants or transmitted with payments. Store clerks and employees do not see a user's credit card at whatsoever betoken, and they too do not have admission to personal information like a proper noun or accost considering an ID is non required for verification purposes.

Furthermore, if an iPhone is lost, the possessor can use Detect My iPhone to suspend all payments from the device, without needing to become through the hassle of canceling credit cards.

Banks are confident in Apple Pay's security, and have opted to assume liability for any fraudulent purchases made both in retail stores and online using the organization.

Privacy

Apple has been careful to point out the company does non store or monitor the transactions that people make with Apple tree Pay. Apple tree says it does not know what people are purchasing, nor does it save transaction information.

"We are not in the business of collecting your data," said Boil Cue during the keynote speech introducing Apple Pay. "Apple doesn't know what you bought, where y'all bought it, or how much yous paid. The transaction is betwixt y'all, the merchant, and the banking concern."

U.S. Partners

Uniform Credit Cards and Banks

Apple has partnered with the major credit and debit card companies in the U.s.: Visa, MasterCard, Discover, and American Limited. Apple has as well signed deals with major banks, including Depository financial institution of America, HSBC, Capital I, Chase, Citi, American Limited, and Wells Fargo, plus it has established deals with hundreds of smaller banks across the country.

A current list of bank partners can be institute on Apple'south participating banks support document.

Shop Credit Cards:

In October of 2022, Kohl'due south became the start retail shop to allow Apple Pay to exist used with its in-store credit cards. Kohl'south Accuse Cards can now be added to Apple Pay and used to brand purchases in Kohl's retail stores. In May of 2022, Kohl's likewise became the first retailer to support both store payments and rewards with a single tap in Apple tree Pay, allowing users to automatically go rewards points when using their Kohl'south cards without the demand for a second Apple Pay transaction.

BJ'south Wholesale Order Credit Cards began working with Apple Pay in December of 2022. JCPenney also began supporting Apple Pay in mid-2017 for its store cards, and other stores have also been implementing rewards into Apple Pay.

Retail Partners:

Considering Apple tree Pay is based on already existing NFC engineering science, the service works in hundreds of thousands of locations that accept contactless payments in the countries where Apple tree Pay is accepted. Apple Pay launched with a handful of partners, but over the course of the concluding two years, many more stores take begun accepting the payments service.

Apple Pay is accepted in more than a million retail stores, restaurants, gas stations, grocery stores, and more across the United States. By the first of 2022, Apple Pay was available in 65 percent of U.S. retail locations. 74 of the meridian 100 merchants in the U.s.a. accept Apple Pay.

Some of Apple's partners include Best Buy, B&H Photograph, Bloomingdales, Chevron, Disney, Dunkin Donuts, GameStop, Jamba Juice, Kohl's, Lucky, McDonald's, Function Depot, Petco, Sprouts, Staples, KFC, Trader Joe'due south, Walgreens, Safeway, Costco, Whole Foods, CVS, Target, Publix, Taco Bell, and 7-11.

Transit systems in Philadelphia, Portland, Chicago, New York, Boston, San Diego, Los Angeles, Hong Kong, Toronto, Montreal, Washington, D.C., San Francisco, and 275 cities in Mainland china take added support for Apple Pay, with a list of states, countries, and regions that support Apple Pay for transit available here.

Apple tree Pay can be used to pay for transit on iPhone and Apple tree Watch, and in many of the above listed areas, Limited Transit Fashion is bachelor. With Express Transit Mode, the iPhone and Apple Watch tin can exist used to quickly pay for rides without having to unlock the device, open an app, or validate with Face ID/Bear on ID.

Apple Pay is also available in many places outside of traditional retail stores, including universities, ballparks, non-turn a profit organizations, Bitcoin payment providers, and even ATMs from Bank of America, Chase, and Wells Fargo.

A full list of locations where Apple Pay is accepted in the United states can be establish on Apple's Apple Pay website.

Apps:

Apple tree Pay support tin exist built into any app, and thousands of apps, representing businesses both big and small, accept Apple Pay as a payment method in their apps. When used in an app, Apple Pay payments tin can exist made on iPhones and iPads equipped with Touch ID fingerprint sensors.

Apple Pay Loyalty Carte Integration

In the fall of 2022, Apple Pay began working with various store loyalty programs, assuasive customers with loyalty cards stored in the Wallet app to apply them over NFC in participating stores. Loyalty cards from eligible stores added to Wallet pop up at NFC terminals just like credit cards.

Walgreens was the first company to support the Apple tree Pay loyalty program. Walgreens customers can add their Walgreens rewards cards to Wallet where they can be used like any other credit or debit card during the checkout process to earn rewards points.

Checking out with a rewards menu is a two-step process in nearly stores -- beginning information technology'south necessary to activate the rewards card with a finger on Touch ID, followed by the bodily payment. Kohl's is an exception, having introduced 1-touch rewards and payment integration.

Goldman Sachs Partnership

Apple tree and Goldman Sachs partnered to launch credit carte du jour called Apple Bill of fare that features Apple Pay branding and offers two per centum cash back on Apple tree Pay purchases. Goldman Sachs replaced Barclays as Apple'southward financing partner, and Apple tree Card also offers financing options for Apple tree products in improver to cash bonuses for Apple Pay purchases. The Apple Card is limited to the The states at the current fourth dimension.

Apple tree'southward Cut

Apple tree collects a fee from banks each time consumers utilise the Apple Pay payment solution to make a purchase. Co-ordinate to rumors, Apple has struck private deals with each bank it has partnered with, including Hunt, Bank of America, Wells Fargo, and more.

Apple'south cut is reportedly at approximately 0.15 per centum of each purchase, which equates to 15 cents out of each $100 purchase.

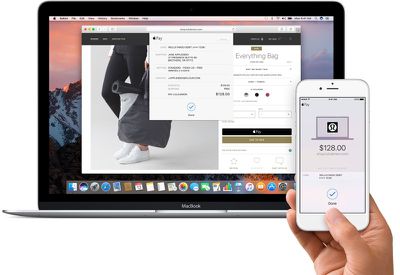

Apple tree Pay on the Web

With iOS 10 and macOS Sierra, Apple tree Pay expanded to websites. Participating websites have begun offering Apple tree Pay as a payment option when checking out, giving Apple Pay users an culling to payments services like PayPal. Many websites and payment providers like Stripe, WePay, and SquareSpace back up Apple tree Pay on the spider web.

On Macs with a Touch Bar, purchases are verified through Bear upon ID. On other machines, purchases are verified through a connection to an Apple Spotter or an iPhone, with the purchase authorized via Impact ID/Confront ID, and on the iPhone and iPad, purchases are authorized through Touch ID (or Face ID on iPhone X) as normal.

Apple Cash

In iOS eleven.2, Apple introduced Apple Cash (formerly Apple tree Pay Greenbacks), designed to let users to send peer-to-peer Apple Pay payments using Messages on the iPhone, iPad, and Apple Watch. Apple tree Cash lets you send money to friends and family with a continued debit card, like to services like Square Cash or Venmo.

Money can exist sent in Messages using standard fingerprint/face authentication (or skin authentication on the Apple Scout), and funds received are bachelor in a new Apple Cash card that'due south located in Wallet. This carte tin exist used to make Apple tree Pay purchases where Apple Pay is accepted (similar to whatever other credit or debit card stored in Apple Pay), or information technology can be transferred to a bank account. Apple tree partnered with prepaid card provider Dark-green Dot for the Apple Cash card.

Sending money using Apple Cash via Messages requires an Apple Pay-compatible device, which includes the iPhone SE, iPhone 6 or later, iPad Pro, iPad 5th & 6th generation, iPad Air 2, iPad mini iii or later, and Apple Lookout. Person-to-person payments are express to the United States at the electric current time.

Like many peer-to-peer money transferring services, sending coin is free when a debit carte is used, and while Apple used to let money to exist loaded using a credit card for a pocket-sized fee, yous tin now just add money to Apple Greenbacks via a debit card.

Apple Cash is express to the Us, but could soon aggrandize to several countries in Europe.

According to a contempo study past Consumer Reports, Apple Cash is the best peer-to-peer mobile payments service thanks to Apple tree's robust security and privacy policies. Apple Cash beat out Venmo, Foursquare Cash, Facebook Messenger payments, and Zelle.

The Apple Carte

Apple in August 2022 introduced the Apple Bill of fare, its ain credit menu in partnership with Goldman Sachs and Mastercard. The Apple Card is a new physical and digital credit menu that iPhone users in the U.Due south. tin can sign up for on the iPhone.

Apple Card works like a traditional credit menu, just information technology is deeply integrated into the Wallet app, offer up real-time views of the latest transactions and a consummate overview of spending organized past category along with payment options optimized for encouraging minimal interest.

Apple is offering a "Daily Greenbacks" cash back programme that gives you lot i percent cash dorsum on all purchases, 2 percentage greenbacks back on all Apple Pay purchases fabricated with Apple Carte, and 3 percent on all Apple-related purchases at Apple retail stores, the App Shop, iTunes, and some third-party partner stores. Daily Cash is immediately available in the Wallet app, delivered on the Apple Cash card.

Apple likewise offers three percent cash back when using the Apple tree Card with Apple Pay for Uber, Uber Eats, T-Mobile, Walgreens, Nike, and Duane Reade purchases. In the future, Apple also plans to bring three percent cash back rewards to other merchants and apps.

Customer support for Apple tree Card is done through the Messages app, and there are no fees associated with the carte. Apple is aiming to provide low interest rates, but April is exist based on credit score and credit approving is required. Privacy is a major focus, and the physical Apple Card - fabricated out of titanium engraved with your proper name - has no number on it, no signature, and no expiration date, with info instead stored in the Wallet app.

We have a full guide with everything that you need to know about Apple Card available here.

Tap to Pay on iPhone

Apple tree in February 2022 introduced "Tap to Pay on iPhone," a feature designed to allow NFC-compatible iPhones to have payments through Apple Pay, contactless credit and debit cards, and other digital wallets, without requiring additional hardware.

The Tap to Pay feature is coming in the spring and it volition work with the iPhone XS or later, allowing supported iOS apps to accept iPhone to iPhone payments. At checkout, a merchant is able to prompt a client to concord their iPhone, Apple tree Spotter, contactless credit or debit carte du jour, or other digital wallet close to the merchant's iPhone to complete a payment over NFC.

Stripe has announced that it will be the starting time payment platform to offering Tap to Pay on iPhone to business customers, including Shopify users, later this spring. Apple tree Stores in the U.South. will also roll out support for the feature later this year.

International Expansion

UK

On July 13, 2022, Apple Pay expanded beyond the United States for the first time, launching in the United Kingdom. As in the U.S., Visa, MasterCard, and American Express all supported Apple Pay at launch. Britain Banks supporting Apple tree Pay at launch included MBNA, Nationwide, NatWest, Purple Bank of Scotland, Santander, and Ulster Banking company. First Straight, HSBC, Clydesdale Bank, Yorkshire Banking company, Metro Banking concern, The Co-Operative Bank, Starling Bank, and digital banking service B added support at a later date.

Apple has a listing of all the Great britain banks that support Apple Pay on its Uk Apple Pay site. Most of the major banks in the country support the payments service, including holdout Barclays, which began accepting Apple Pay in April after a long delay.

More than than 250,000 locations in back up Apple Pay, ranging from fast food places like KFC and McDonald's to shops like Boots, Marks & Spencer, and Waitrose. A full listing of retail shops and apps that take Apple tree Pay can be found on Apple tree's website. Many United kingdom of great britain and northern ireland-based apps are also accepting Apple tree Pay, like Zara, TopShop, Five Guys, Hotel Tonight, Miss Selfridge, and more.

British territories Guernsey, Isle of Man, and Jersey also support Apple Pay.

Australia

Apple Pay became bachelor in November of 2022 through a partnership with American Express, allowing American Express cardholders to use Apple Pay at whatever retailer that accepts contactless payments, but later Visa, Mastercard, and eftpos began supporting Apple Pay. In April of 2022, Apple Pay expanded to ANZ, the commencement of Australia'due south 4 major banks to implement Apple Pay support.

At launch, Australia's Commonwealth Bank (CBA), Westpac, and NAB attempted to engage in commonage bargaining with Apple in an effort to strength Apple to open up up the iPhone'south NFC capabilities to support other digital wallets, simply the attempt was blocked by the Australian regime and as of April 2022, all of the four major banks in Commonwealth of australia back up Apple Pay.

Through a partnership with Cuscal, Apple Pay is also available at more than than 31 small banks and credit unions, making it available to four million Australians who are customers of those financial institutions. ING Direct and Macquarie have also implemented Apple tree Pay support, as have HSBC and Bendigo. In April of 2022, Citibank added Apple Pay support in Commonwealth of australia.

A list of retailers that officially back up Apple Pay in Commonwealth of australia tin can be found on the Australian Apple Pay website.

Canada

Apple Pay launched in Canada in November of 2022 through an American Express partnership, assuasive American Express cardholders in Canada to use Apple tree Pay at any retailer that accepts contactless payments.

After debuting through the American Limited partnership in 2022, Apple Pay in Canada expanded to two major Canadian banks, RBC and CIBC, on May 10, 2022. Apple Pay further expanded to Canada Trust, Scotiabank, BMO, Tangerine, and MBNA, and with all major Canadian banks accepting Apple Pay, the payments service is bachelor 90 percent of Canadian banking customers.

A list of participating retailers and banks in Canada is available on Apple's Canadian Apple tree Pay website.

China

Apple Pay launched in People's republic of china on Feb 18, 2022, through a partnership with China UnionPay, China's country-run interbank network. China UnionPay card holders with an eligible debit or credit card can use their cards at any location that has a UnionPay-compatible point-of-auction system bachelor. Apple has signed deals with xix of the biggest lenders in People's republic of china, making 80 per centum of credit and debit cards in China eligible for use with Apple Pay.

Hong Kong

Apple Pay launched in Hong Kong on July 20, 2022, with support for Visa, MasterCard, and American Express debit and credit cards issued by Hang Seng Bank, Depository financial institution of China (Hong Kong), DBS Bank (Hong Kong), HSBC, Standard Chartered, Citibank, and straight from American Express. BEA and Tap & Get began accepting Apple Pay shortly later in Baronial of 2022.

Apple Pay retailers in Hong Kong include 7-Eleven, Apple, Colourmix, KFC, Lane Crawford, Mannings, McDonald'due south, Pacific Coffee, Pizza Hut, Sasa, Senryo, Starbucks, ThreeSixty, and everywhere else contactless payments are accustomed.

Macau

Apple tree Pay launched in Macau, a Special Administrative Region of People's republic of china, in August 2022. Apple Pay in Macau works with Banco Nacional Ultramarino (BNU) and UnionPay International Hong Kong Branch (UPI).

Singapore

Apple tree Pay launched in Singapore in April of 2022 through a partnership with American Limited. Apple Pay support after expanded to encompass Visa, American Express, and Mastercard credit and debit cards issued by POSB, DBS, OCBC, Standard Chartered, UOB, HSBC, and Citibank. Apple Pay is at present available to more 80 percent of Visa and Mastercard cardholders in the country.

A list of retail locations where Apple tree Pay is accepted can be found on Apple tree'due south Singapore website.

Switzerland

Apple Pay expanded to Switzerland on July 7. Apple Pay is available for MasterCard and Visa credit and debit cards issued by Bonus Card, Cornèr Bank, Swiss Bankers, and UBS.

Apple Pay is accustomed at many retailers in Switzerland, including ALDI SUISSE, Apple tree, Avec, Hublot, K Kiosk, Lidl, Louis Vuitton, Mobilezone, Press & Books, SPAR, TAG Heuer, and everywhere else contactless payments are accepted.

French republic

Apple tree Pay expanded to France on July 18, 2022. MasterCard and Visa credit and debit cards issued past Banque Populaire, Ticket Restaurant, Carrefour Banque, Caisse d'Epargne, BNP Paribas, HSBC Bank, Vivid Money, and more are available for use with Apple Pay in the country.

Every bit listed on the Apple tree Pay France website, Apple tree Pay is bachelor at a broad range of retailers like Bocage, Le Bon Marché, Cojean, Dior, Louis Vuitton, Fnac, Sephora, Flunch, Parkeon, Pret, and more.

Japan

Apple tree Pay became bachelor in Japan on October 24, 2022. Apple Pay in Nihon works with credit and debit cards issued past American Express, Visa, JCB, Mastercard, Aeon Fiscal, Orico, Credit Saison, SoftBank, d Menu, View Menu, MUFG Card, APLUS, EPOS, JACCS, Cedyna, POCKETCARD, Life, and more.

Suica and PASMO transit systems are compatible with Apple Pay and Express Transit fashion in Nihon, allowing users to pay for transit fares and other transactions with the iPhone or Apple Watch. Many retail locations, shops, restaurants, and other areas in Japan besides support Apple Pay, with details on Apple's Japanese Apple Pay website.

Russian federation

Apple pay expanded to Russia on October 4, 2022, with the payment service bachelor for use with the post-obit financial institutions: Tinkoff Depository financial institution, Depository financial institution Saint Petersburg, Raiffeisenbank, Yandex.Coin, Alfa-Bank, MTS Bank, VTB 24, Rocketbank, MDM Bank, and Mir, Russian federation's national payment system.

Participating retailers in the country include TAK, Magnit, Media Markt, Auchan, Azbuka Vkusa, bp, M.Video, TsUM and authorized Apple reseller re:Shop. A full listing is available on Apple's Russian Apple Pay website.

Belarus

Apple Pay launched in Belarus on November xix, bachelor to BPS Sberbank customers who have a Visa or Mastercard. BPS Sberbank is the Belarusian branch of PJSC Sberbank, a atate-endemic Russian bank.

New Zealand

Apple Pay launched in New Zealand through a partnership with ANZ on Oct 12, 2022. Apple Pay initially only worked with credit and debit cards issued by ANZ, but BNZ added support in October of 2022. Westpac later began supporting Apple Pay in 2022.

Apple tree Pay is bachelor at many locations in New Zealand, including McDonald'due south, Domino's, Glassons, K-Mart, Hallenstein Brothers, Stevens, Noel Leeming, Tempest, and more than, with a full listing available on the Apple Pay New Zealand website.

Spain

Apple Pay launched in Spain on December 1, 2022. Apple Pay is bachelor to American Express, CaixaBank, ImaginBank, ING, Banco de Santander customers, and credit and debit cards issued by Carrefour and Ticket Eating house are also accustomed.

A full list of Apple tree Pay retail partners and compatible apps is located on Apple'due south Spanish website.

Republic of ireland

Apple tree Pay expanded to Ireland in March of 2022. Apple Pay is available for Visa and MasterCard holders that depository financial institution with KBC, Banking company of Republic of ireland, Ulster Bank, AIB, Permanent TSB, and more than.

Participating retailers in Ireland include Aldi, Amber Oil, Applegreen, Boots, Burger King, Centra, Dunnes Stores, Harvey Norman, Lidl, Marks and Spencers, PostPoint, SuperValu, and more than, with a full list of participating retailers available on the Irish Apple Pay website.

Taiwan

Apple Pay launched in Taiwan on March 28, 2022. Apple Pay is available to Visa and MasterCard holders who are customers of Cathay United Bank, CTBC Bank, E. Dominicus Commercial Bank, Standard Chartered Bank, Taipei Fubon Commercial Bank, Taishin International Bank, and Union Bank of Taiwan.

A listing of stores and websites that back up Apple Pay in the country is bachelor on Apple tree's Taiwan Apple Pay website.

Italia

Apple Pay launched in Italy in May of 2022, post-obit hints of an imminent launch for weeks. Apple tree Pay works with American Express cards issued by American Express, and Visa and MasterCards issued by Carrefour, UniCredit, Banca Mediolanum, ING, and others.

Apple Pay works in retail stores that have contactless payments, with a list of partners bachelor on Apple tree'southward Italian Apple Pay website.

Denmark

Apple Pay launched in Denmark in October of 2022. Jyske Bank (Visa debit cards only), Arbejdernes Landsbank, Spar Nord, Nordea, and Danske Banking company support Apple Pay in Kingdom of denmark. Apple Pay payments are accustomed wherever contactless payments are available, and a list of supported retailers and more information on Apple tree Pay can be found on Apple's Apple Pay website in Denmark.

Finland

Apple Pay launched in Finland in Oct of 2022.In Republic of finland, credit and debit cards from Nordea, Aktia, and ST1 work with Apple tree Pay. Apple tree Pay payments are accepted wherever contactless payments are available, and a list of supported retailers and more information on Apple Pay tin be establish on Apple tree's Finland Apple Pay website.

Sweden

Apple Pay launched in Sweden in Oct of 2022. In Sweden, credit and debit cards from Nordea, Swedbank, and ST1 work with Apple tree Pay. Apple Pay payments are accepted wherever contactless payments are available, and a list of supported retailers and more information on Apple Pay can be found on Apple's Apple Pay website in Sweden.

United Arab Emirates

Apple Pay launched in UAE in October of 2022. In the United Arab Emirates, several banks are supporting Apple Pay, including Emirates Islamic (Visa credit, debit, and prepaid cards), Emirates NBD, HSBC (Visa and Mastercard credit and debit cards), mashreq, RAKBANK (Mastercard credit, debit, and prepaid cards), and Standard Chartered Bank.

Apple Pay payments are accepted wherever contactless payments are bachelor, and a listing of supported retailers and more information on Apple Pay tin can be found on Apple'due south UAE Apple Pay website.

Brazil

Apple tree Pay expanded to Brazil in April of 2022 through a partnership with Brazilian bank Itaú Unibanco. Apple Pay can be used with credit and debit cards issued by Itaú Unibanco in retail stores where NFC payments are accustomed and within apps.

Apple tree Pay in Brazil is acccepted in several retail stores, including Starbucks, Taco Bell, Cobasi, Bullguer, Fast Store, and more, with a full listing of locations bachelor on Apple's Apple Pay website in Brazil.

Ukraine

Apple tree Pay became available in Ukraine on May 17, 2022. The service works with credit and debit cards issued by PrivatBank at the current fourth dimension, with Oschadbank planning to add together support for Apple Pay in the time to come.

Poland

Apple Pay launched in Poland on June eighteen, 2022, and information technology works with Visa and Mastercard credit and debit cards issued by the following banks: BGZ BNP Paribas, Bank Zachodni WBK, Alior Bank, Raiffeisen Polbank, Nest Bank, mBank, Bank Pekao, Banking concern Millennium, and Getin Bank.

Norway

Apple Pay launched in Kingdom of norway on June 19, 2022, and it works with Visa and Mastercard credit and debit cards from Nordea and Santander Consumer Finance.

Belgium

Apple Pay launched in Belgium in Nov 2022 through an exclusive partnership with BNP Paribas Fortis and its subsidiary brands Fintro and Hi Bank. Customers of these banks are able to use Apple Pay to make payments for purchases online, in apps, and in retail locations that back up contactless payments. Apple Pay availability subsequently expanded to KBC in 2022, and ING Belgium in 2022.

Republic of kazakhstan

Apple Pay launched in Kazakhstan in November 2022. Apple tree Pay is available to Visa and Mastercard credit and debit carte du jour holders in Kazakhstan who bank with Eurasian Banking concern, Halyk Bank, ForteBank, Sberbank, Bank CenterCredit, and ATFBank.

Federal republic of germany

Apple Pay launched in Germany on Dec x, 2022, with the service available through American Express, Deutsche Bank, Viabuy, Consorsbank, Hanseatic Bank, HypoVereinsbank, Edenred, Comdirect, Fidor Bank, Sparkasse, Sparkassen-Card, Commerzbank, and mobile banks and payment services o2, N26, bunq, and VIMpay.

Apple tree Pay in Deutschland tin exist used at retailers that include Aldi, Burger King, Lidl, McDonalds, MediaMarkt, Pull&Deport, Beat, Starbucks, Vapiano, and many more locations, equally listed on Apple'southward Apple Pay site for Federal republic of germany.

Saudi Arabia

Apple tree Pay launched in Saudi Arabia on February nineteen, 2022. Information technology is available for Visa and Mastercard holders that bank with Al Rajhi Bank, NCB, MADA, Riyad Bank, Alinma Bank, and Depository financial institution Aljazira.

A listing of locations where Apple Pay can be used in Kingdom of saudi arabia is available on the Apple Pay website for Saudi Arabia.

Czech Republic

Apple tree Pay launched in the Czechia on Feb 19, 2022. Apple tree Pay in the country works with Air Bank, Česká spořitelna, J&T Banka, Komerční banka, MONETA Money Bank, mBank, and payments service Twisto.

A list of locations where Apple Pay is accepted in the Czechia can be plant on Apple's Apple Pay website for the state.

Austria

Apple Pay became bachelor in Austria in April 2022. Erste Bank, Sparkasse, N26, Bank Austria, and Raiffeisen Banking concern support Apple tree Pay in Austria, so customers from these banks tin can add their credit and debit cards to the Wallet app for use with Apple Pay.

A list of locations where Apple Pay is accustomed in Austria can be found on the Austrian Apple tree Pay website.

Republic of iceland

Apple Pay launched in Iceland in May 2022, assuasive customers who bank with Landsbankinn and Arion banki to use their credit and debit cards with the Apple tree Pay service to brand contactless payments.

Hungary

Apple Pay launched in Hungary in May 2022, allowing OTP Bank customers use Apple tree Pay with their credit and debit cards. A list of locations where Apple Pay can exist used in Republic of hungary is available via Apple'due south Apple tree Pay website in the country.

Luxembourg

Apple Pay launched in Grand duchy of luxembourg in May 2022, assuasive BGL BNP Paribas customers use Apple Pay with their credit and debit cards. At this time, BGL BNP Paribas is the sole depository financial institution supporting Apple Pay. A list of locations where Apple Pay can be used in Grand duchy of luxembourg is available via Apple's Apple Pay website in the land.

Kingdom of the netherlands

Apple Pay launched in The netherlands in June 2022, assuasive customers of ING, Bunq, Monese, N26, Revolut, ABN AMRO, Rabobank, and De Volksbank (parent company of SNS, ASN Bank, and RegioBank), to brand Apple tree Pay purchases with debit and credit cards.

Apple Pay can be used in Kingdom of the netherlands with several online and high street retailers including Adidas, ALDI, Amac, ARKET, BCC, Burger King, Capi, absurd blue, COS, Decathlon, Douglas, H&M, Jumbo, Lidl, McDonalds, Starbucks, and others, with a full list available on Apple's Apple Pay website for Kingdom of the netherlands.

Georgia

Apple Pay expanded to the country of Georgia in September 2022. It is available to Banking concern of Georgia credit card holders.

Major European Expansion

In June of 2022, Apple Pay expanded to multiple European countries including Bulgaria, Croatia, Cyprus, Estonia, Greece, Latvia, Liechtenstein, Republic of lithuania, Malta, Portugal, Romania, Slovakia, and Slovenia.

Apple Pay works with a number of pop banks in these countries, with details available for each state on Apple tree's website.

Serbia

Apple Pay launched in Serbia in June 2022, allowing Mastercard users who bank with ProCredit to add their cards to the Wallet app for contactless Apple Pay payments.

Republic of korea

Apple is in the early on stages of discussions to bring Apple Pay to South korea, but it may yet exist some time before the service launches in the land. Because NFC terminals are not common in South korea, Apple needs to encourage more retailers to implement NFC back up.

Israel

Apple Pay launched in Israel in May 2022, and all banking company and credit card companies in the country back up Apple Pay. Not all credit cards are supported, all the same.

Bank Hapoalim, Bank Leumi, Banking concern Massad, Discount Bank, The Starting time International Bank Group, ICC-CAL, Isracard, Pepper Bank, MAX, Mercantile Banking concern, and Mizrahi-Refahot support Apple Pay.

Mexico

Apple Pay launched in Mexico on February 23, allowing Citibanamex, Banorte, HSBC, and Inbursa customers with American Express and MasterCard debit and credit cards to use Apple Pay in the country when making contactless payments.

Many stores in Mexico support Apple Pay, including 7-Eleven, Petco, PF Changs, Xcaret, and more than, with a total list available on the Apple Pay Mexico website.

South Africa

Apple Pay launched in South Africa in March 2022. Apple tree Pay is bachelor for Discovery, Nedbank, Absa, and FNB customers in the country.

Qatar

Apple Pay launched in Qatar in August 2022, and information technology is bachelor with the QNB Grouping, the largest financial establishment in the Eye E and Africa. QNB Bank users in the country tin can employ Apple tree Pay in Qatar, and Apple tree Pay is also bachelor for Dukhan bank users.

Chile

Apple Pay expanded to Chile in September 2022, and information technology is available to Banco de Chile and Banco Edwards customers who take Visa cards.

Bahrain

Apple tree Pay expanded to Bahrain in October 2022, and information technology is available customers with an eligible credit or debit carte du jour.

Palestine

Apple Pay expanded to Palestine in Oct 2022, and it is bachelor customers with an eligible credit or debit card.

Colombia

Apple Pay launched in Colombia in November 2022. Bancolombia customers can add together their Visa and Mastercard credit and debit cards to the Wallet app to make Apple Pay purchases.

Azerbaijan

Apple Pay launched in Azerbaijan in November 2022 for those who bank with Bank Respublika, Unibank Sanin, ABB, and Kapital Bank, allowing card holders to brand purchases through Apple tree Pay.

Costa Rica

Apple Pay came to Republic of costa rica in November 2022, with major banks that include BAC, BCR, Scotiabank, and Promerica offering support.

Peru and Argentine republic

Apple Pay launched in Peru and Argentine republic in March 2022. Banks that support the feature in Peru include Rappi Banking company, International Bank of Peru, Banco de Credito del Republic of peru, and BBVA. Banks that back up Apple Pay in Argentina include Brubank, Banco de Galicia S.A., Banco Macro Due south.A., Banco Patagona Southward.A., and BBVA.

Moldova

Apple Pay became bachelor for Apple users in Moldova in April 2022. Customers of Moldinconbank, Maib, and Victoriabank are able to employ Apple Pay.

India

Apple was working on expanding Apple tree Pay to India, but plans for the payments service in the state have been shelved for the time being due to regulatory issues and technical problems. The Reserve Depository financial institution of India requires companies to store payments data for local users in Republic of india, which has led to uncertainties about Apple Pay's rollout in the country. There is no word on when Apple Pay will come to India.

Competition

Walmart, the biggest retailer in the United States has refused to implement Apple Pay and has instead rolled out its own proprietary payment system, Walmart Pay. With Walmart Pay, customers can make purchases and payments in Walmart retail locations using a QR lawmaking in the Walmart app. Walmart Pay is available nationwide at all Walmart locations.

Other Apple Pay competitors include Samsung Pay and Google Pay (formerly known as Android Pay), two mobile payment solutions created past Samsung and Google, respectively. These payment solutions are largely designed for Android devices, but even iPhone users can use Google Pay Send for sending money to friends.

How To Set Up Apple Pay On Iphone Se,

Source: https://www.macrumors.com/roundup/apple-pay/

Posted by: crispnegards.blogspot.com

0 Response to "How To Set Up Apple Pay On Iphone Se"

Post a Comment